Following the acquisition of the trade and business assets from Northern Employment Services...

Following the acquisition of the trade and business assets from Northern Employment Services...

Following the increasing number of reports to Action Fraud surrounding recruitment scams, Me...

Today, we are proud to announce the launch of Meridian's brand-new website! Not only has...

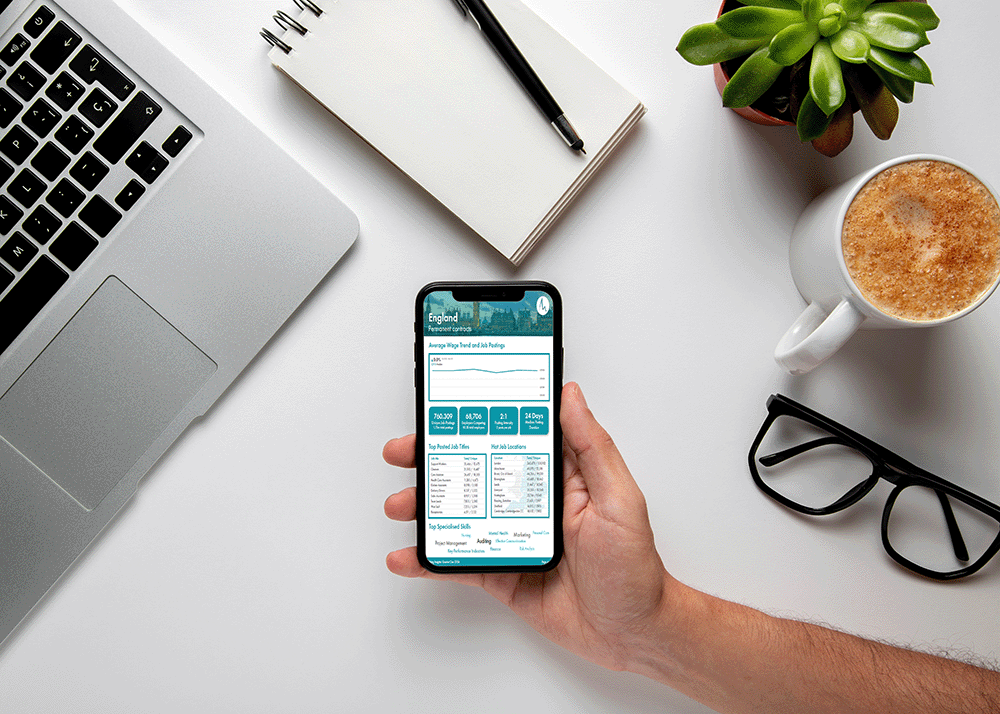

In our latest Hiring Insights report, we look at the UK job market’s performance in Q1 2024....